Increase insurance

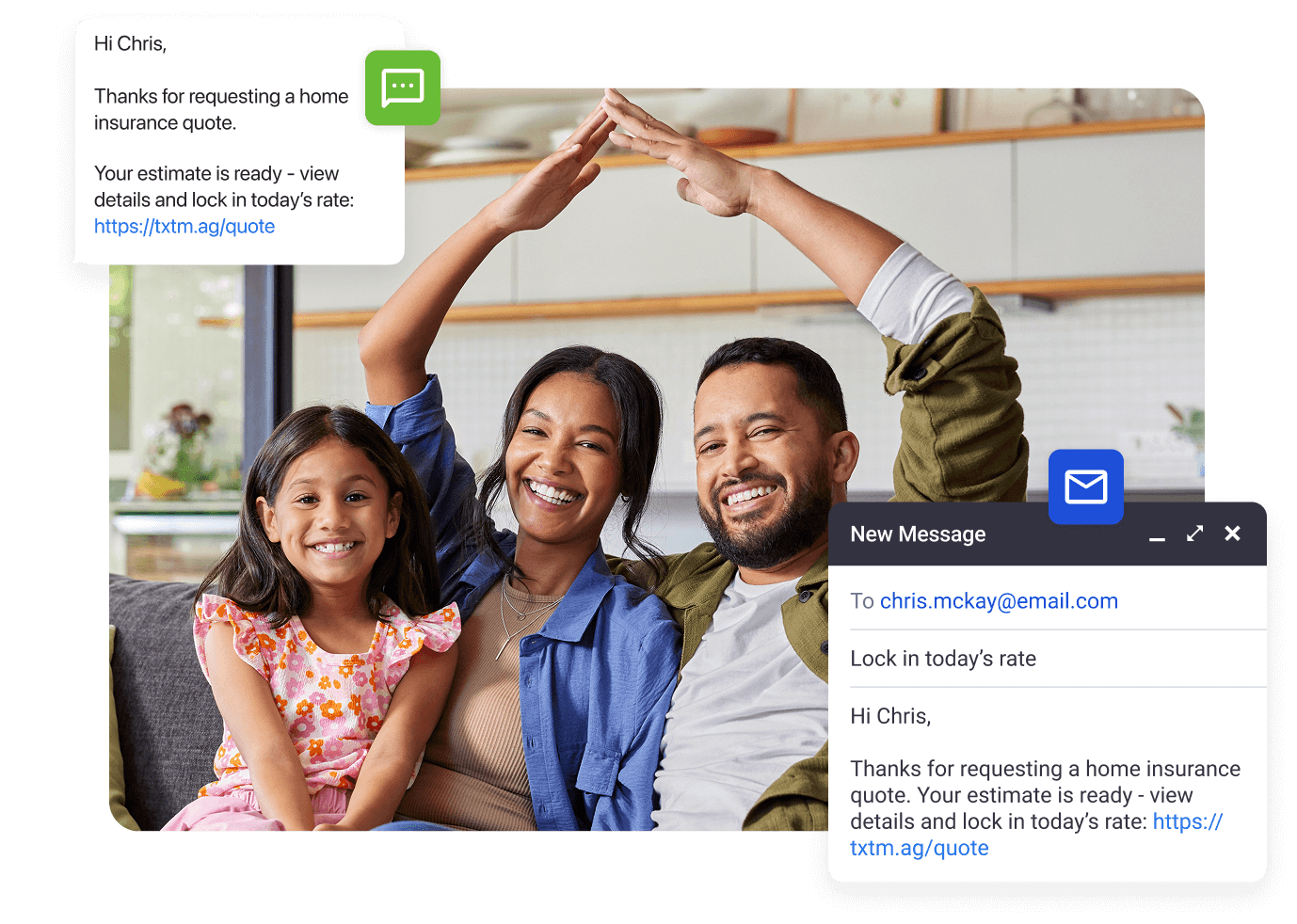

conversions with reliable SMS and Email

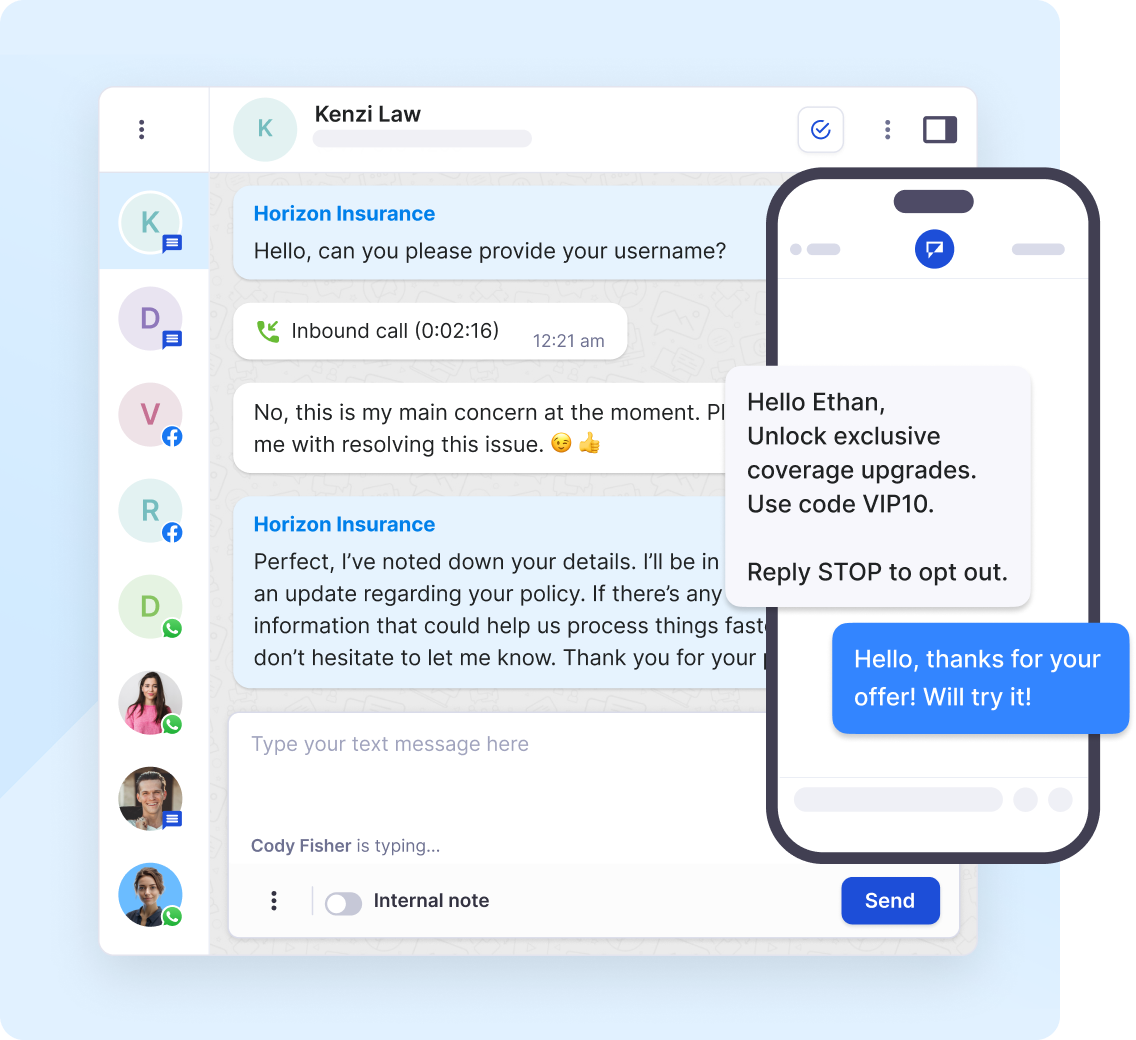

Replace fragmented tools with one platform to handle seasonal spikes and follow-ups, and use 2FA and account alerts when engaging insurance leads.

Why do top insurance companies choose Textmagic?

Fast lead capture & follow-up

Convert quote requests, website leads, and event sign-ups into policies faster with instant, compliant communication.

Easy enrollment & onboarding

Cut through busy enrollment periods like health plan renewals or new policy sign-ups. Nudge clients to complete documents and finalize their coverage on time.

Stronger policy retention

Keep clients informed and engaged with timely renewal reminders, premium notices, and lapse prevention messages that reduce churn.

Simple cross-sell and upsell

Maximize every client relationship with targeted campaigns for life, auto, property, umbrella policies, and retirement planning, without extra tools or manual follow-ups.

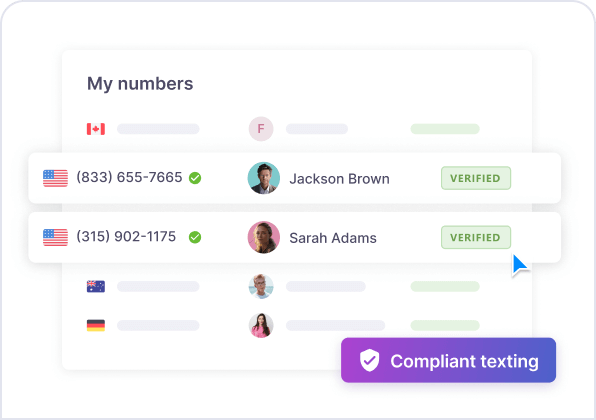

Compliance & consent control

Protect sensitive data, maintain clean audit trails, and stay compliant while communicating securely across every channel.

Fast lead capture & follow-up

Convert quote requests, website leads, and event sign-ups into policies faster with instant, compliant communication.

Easy enrollment & onboarding

Cut through busy enrollment periods like health plan renewals or new policy sign-ups. Nudge clients to complete documents and finalize their coverage on time.

Simple cross-sell and upsell

Maximize every client relationship with targeted campaigns for life, auto, property, umbrella policies, and retirement planning, without extra tools or manual follow-ups.

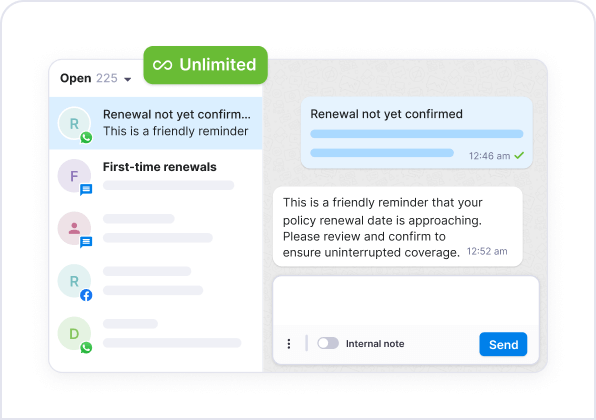

Stronger policy retention

Keep clients informed and engaged with timely renewal reminders, premium notices, and lapse prevention messages that reduce churn.

Compliance & consent control

Protect sensitive data, maintain clean audit trails, and stay compliant while communicating securely across every channel.

Power faster, clearer communication for your entire insurance team

Effective client scheduling

Automate lead follow-ups and appointment reminders to convert more insurance prospects, faster.

Claim status updates

Share timely claims updates, so clients stay in the loop without extra work for your team.

Policy renewals and changes

Keep clients informed with automated policy reminders, premium alerts & lapse prevention.

Efficient enrollment administration

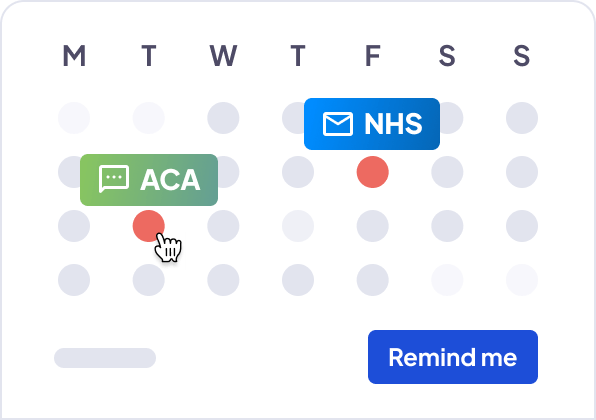

Support ACA, NHS, OHIP, or Medicare enrollment with clear reminders and document inquiries.

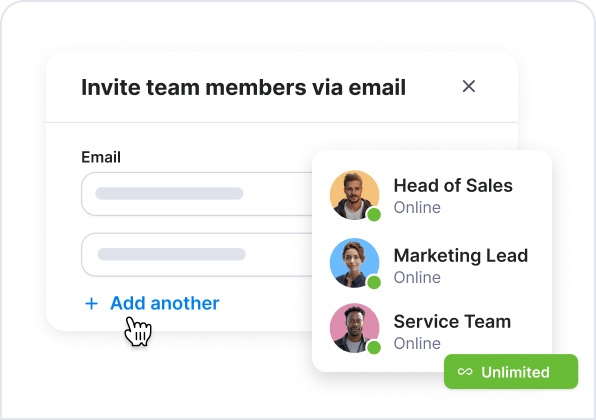

Staff bandwidth management

Help marketing, service, and sales teams work efficiently from one place during peak seasons.

Compliance & audit readiness

Maintain clean consent records, secure data, and complete audit trails for regulatory confidence.

Manage insurance business communication from one place

Join 5,000+ insurance businesses worldwide that rely on Textmagic

- Rated ★★★★★ on Capterra & G2

- Over 20 years of trusted communication solutions

- Driving 20+ million insurance text messages monthly

“Textmagic has made connecting with our customers much more easier and efficient.”

“The process is so fast and easy, everyone in the office can use it. Just one new client a month and the system more than pays for itself.”

Explore additional resources for insurance agencies

SMS opt-in and opt-out: A guide to effective messaging compliance

Having accessible SMS opt-in and SMS opt-out mechanisms is essential for the success of your campaigns. Giving and withdrawing con…

Actionable ways to use text messaging for debt collection

Be aware: In North America, sending such texts is strictly forbidden, and this type of campaign is prohibited to safeguard consume…

10 Sectors making the most of text message marketing

Text messaging has become a popular, effective marketing solution for businesses across various industries, and the versatility of…

Frequently asked questions

Haven’t found what you were looking for? Contact us now

Yes, SMS can be compliant for insurance communications, but it depends on how messages are sent and what information they contain.

Insurance teams must take care not to include sensitive PHI (Protected Health Information) or PII (Personally Identifiable Information) in text messages unless proper safeguards and consent are in place. Instead, SMS is best used for notifications, reminders, and secure links that direct clients to authenticated portals for sensitive data.

Textmagic supports compliance by enabling contact consent management, opt-out mechanisms, audit trails, and controlled message templates, helping your organization align with regulations such as HIPAA, TCPA, and data protection laws in your region.

Yes. Textmagic fully supports two-way messaging, allowing clients to reply to your texts just like a regular conversation. This makes it easy to handle real-time Q&A, gather quote qualifiers, and send or confirm document checklists without back-and-forth emails or phone calls.

Agents can manage all inbound and outbound messages from a shared inbox, ensuring that no client reply slips through the cracks. This improves response times, keeps communication organized across teams, and creates a more seamless experience for both agents and clients.

Yes. With Textmagic, you can schedule renewal and payment reminder messages in advance and trigger them automatically using data from your CRM, calendar, or custom fields.

You can set reminders at key intervals (e.g., 30, 15, or 7 days before a policy renewal date) so clients are notified on time without manual follow-ups. This ensures important renewal and payment communications are never missed.

You can collect contacts for insurance messaging through multiple compliant and efficient methods. Textmagic lets you import existing contact lists from your CRM or spreadsheets, sync contacts automatically through integrations (Zapier or native connectors), or capture new contacts through web forms, landing pages, or keyword opt-ins.

For example, clients can text a keyword (like “QUOTE”) to join a specific list, or you can embed lead forms on your website to collect information for health, life, or P&C insurance campaigns. All contacts can be segmented by product type, status, or policy details, making it easy to send targeted, relevant insurance SMS and email campaigns.

Through Zapier and native connectors, Textmagic connects directly with your CRM to sync leads, deals, and activities in real time. You can also automate SMS and email communications based on CRM events such as new lead creation, deal stage changes, or upcoming policy renewals, ensuring timely and relevant outreach.

This eliminates manual data entry, keeps information consistent across systems, and allows your teams to manage communication from one centralized workflow.