Be aware: In North America, sending such texts is strictly forbidden, and this type of campaign is prohibited to safeguard consumers against unsolicited communications.

Cash flow management is a great challenge for businesses. Failure to meet financial goals can result in delayed settlement of salaries and overheads. But how can you persuade clients to pay on time? Sometimes you can’t, and when this happens, you should consider SMS for debt collection.

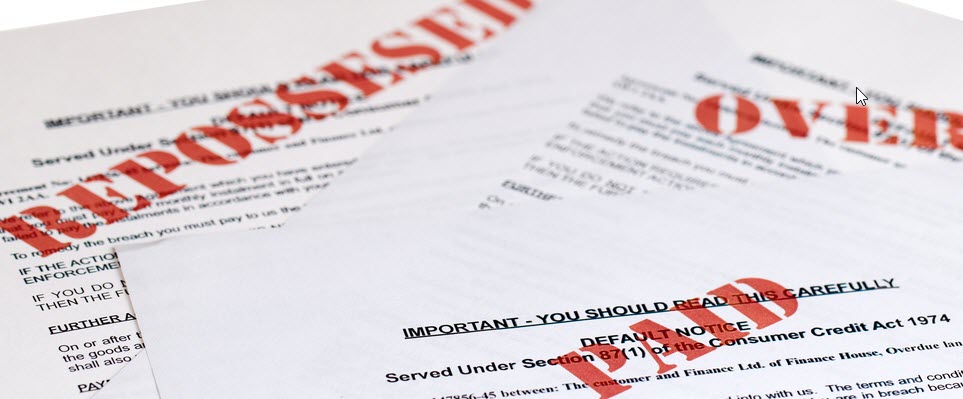

Payment reminders, default judgments, late payment notices, and other traditional debt collection strategies generally result in huge expenses and unreturned phone calls. What if we told you that there is a smarter way to collect debts? And it is virtually free!

Overdue payment reminder SMS are super cheap, but can save your company thousands of dollars. Many debt collection companies automate outstanding payment reminder SMS to reduce expenses and maintain good relations with their customers.

This article shares ten debt collection message examples and tips to help you get your money back.

How can debt collection agents use SMS services?

With text messaging platforms, you can automatically send payment reminders to late payers, personalize messages with account details, and follow up on payment confirmations.

Here are the best applications of SMS services for debt collection that also respect the Debt Collection Practices Act:

- Automate text payment notifications. Send text messages to debtors instantly with our SMS software. Payment reminders can help you reduce collection costs and encourage customers to pay their debts.

- Inform clients of debt collection laws. If clients are unwilling to pay their debts, you can persuade them to do so by sending texts with debt collection laws information. Remember: Your goal isn’t to harass them but to help them understand the legal repercussions of overdue payments.

- Follow up on payment confirmations. Don’t forget to thank your customers and continue offering customer service after they complete a payment. This will improve your relationship and increase their loyalty.

- Schedule payment reminders. Believe it or not, some people simply forget to pay their debts. You can prevent this by sending scheduled SMS reminders ahead of time. Schedule weekly or daily reminders using our software.

- Send SMS messages with account details. Clarity is key. Send personalized SMS messages to clients with information about their account, and provide all the tools they may require. Full transparency and constant updates will make it easier to collect the entire debt.

- Generate auto-responders for common inquiries. You can send automated texts, such as payment plans, debt amounts, interest rates, etc via text. Simply assign keywords to common questions and the software will send automatic replies for you.

- Monitor communication efficiency. Bulk text messaging services provide intuitive dashboards with metrics such as delivery time, delivery status, response rate, costs, etc. Use this information to determine the effectiveness of your strategy.

Useful SMS templates for debt collection

Feel free to use our debt collection text message samples either by copying them or by sending them directly from the Textmagic dashboard:

1. Soft automated reminder

Dear [First Name], we would like to remind you that the amount [Amount] was due for payment on [Date]. To avoid further costs, please forward the payment no later than [Date]. Thank you, [Company Name]

2. Strong automated reminder

Dear [First Name], we have still not received the amount [Amount] that was due on [Date]. Should your payment be received within the next 30 days, we will not take court action. We urge you not to ignore this last reminder. [Company Name]

3. Final overdue payment reminder

Dear [First Name], despite our previous reminders; we have still not received the payment. We regret to inform you that we have no other choice but to undertake legal action against you to retrieve the debt. If this is a mistake please contact us at [Phone] to confirm the payment. [Company Name]

4. Informing debtor of legal action

Dear [First Name], because you failed to pay the debt of [Amount], after multiple attempts of contacting you, we have passed your case to the court. Official court attorneys will notify you about the hearing date.

5. Payment thank you message

Dear [First Name], your payment of [Amount] has been accepted, and your debt has been cleared. Thank you! If you’d like to turn on payment reminders for your account reply with REMIND ME. Thank you, [Company Name]

6. Debt collection law

Hello [First Name], the FTC & FDCPA prohibits debt collectors from using deceptive, unfair, or abusive practices to collect their debt from you. Don’t hesitate to contact us if you encounter any problems! [Company Name]

7. Callback message template

Hello [First Name]! You are receiving this message due to a recent outstanding invoice of [Amount]. Unfortunately, the credit card on file could not be billed. Please give me a call at [Phone] if you require help with the payment. Thank you, [Agent Name]

8. Offering payment options

Hello [First Name]. This is a late payment notice regarding your membership. Because you are an important client for us, we are prepared to offer an extension for the next 14 days. Reply with EXTEND to confirm and make sure to complete the payment by [Date]. Thank you, [Company Name]

9. Invoice notification SMS sample

Hey [First Name]! Your invoice of [Amount] has just been issued. You can review it at bit.ly/invoice-march. The amount is due by [Date]. Please complete the payment by then to avoid having your account restricted. [Company Name]

10. SMS template for automatic payments

Dear [First Name], our system records show that you have an outstanding payment of [Amount]. You can securely pay online or turn on automatic payments by following our guide: bit.ly/automatic-payments. Thank you, [Company Name]

Try out our SMS templates today!

Key benefits of overdue payment reminder SMS for debt collection

Persuading customers to pay using the above debt collection SMS examples will help you in a number of ways. Below are the main benefits of two-way text messaging for debt collection.

- Lift response rates. Reaching out to customers in a way that doesn’t make them uncomfortable is crucial. Many clients refuse to answer calls or emails but will respond to texts.

- Free up vital funds. Traditional debt collection methods will eat away at your business’s budget. Automated text solutions are cost-effective and easy to automate.

- Reach all clients instantly. You can reach all your clients immediately by sending bulk SMS debt collection messages. You can also enable delivery receipts to identify deregistered numbers or failed deliveries.

- Improve customer relationships. Debt collection is stressful for all parties involved. Who knows what unfortunate circumstances may have led to a missed payment? Polite debt collection text message samples provide a non-invasive means of communication.

- Save time. You can save a lot of time with SMS debt collection. Take full advantage of automated messaging software, text templates, and personalization features.

- Create a sense of urgency. Text reminders create a sense of urgency. Always include due dates and other useful information to persuade customers to submit their payments on time.

If you’re having problems implementing these strategies or using any of outstanding payment reminder SMS templates above, feel free to contact us. We’d love to help!

Frequently Asked Questions (FAQs)

Yes, debt collectors can send debtors text messages, but they must follow legal rules.

Under the Fair Debt Collection Practices Act (FDCPA), debt collectors are not allowed to misrepresent the amount debtors owe or falsely claim to be government officials.

Collectors break the law if they lie, harass, or try to scare the debtor into paying. Debtors have the right to fair treatment.

The SMS format for EMI (equated monthly installment) typically includes key details about the loan repayment to keep the borrower informed.

While the exact format can vary by lender, a common structure looks like this:

“Dear [Customer name], your EMI of [amount] for loan account [account number] is due on [date]. Please ensure timely payment to avoid penalties. For assistance, call [customer support number].”

Related articles

10 Sectors making the most of text message marketing

Text messaging has become a popular, effective marke...

Push notifications best practices for successful marketing campaigns

On a daily basis, the average American receives 46 p...

A complete guide to horizontal communication in the workplace

How much time does your team spend in meetings, writ...

RCS vs. SMS: Advantages and differences

Over the years, modern communication has seen signif...

16 Marketing ideas for small business that work like a charm

Marketing ideas for small businesses are often the m...