Build client trust with

SMS and Email for financial businesses

Give clients a simple yet effective way to complete transactions, receive new offers, and resolve issues with a business solution built for the finance industry.

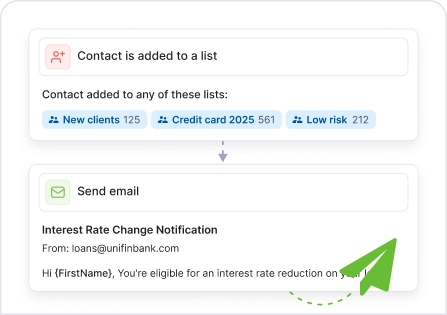

Keep clients informed without the manual work

and updates that drive trust and repeat business.

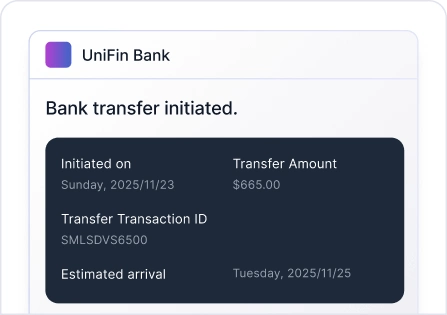

Accelerated loan applications

Send immediate status notifications and document reminders to reduce delays and improve completion rates.

Automated billing reminders

Improve on-time payments automatically by sending timely billing reminders and confirmations that keep clients accountable.

Efficient client intake process

Speed up client intake with automated forms, reminders, and updates to ensure new clients complete everything on time.

Built-in audit trails

Ensure every interaction is recorded, organized, and delivered securely to stay aligned with industry regulations.

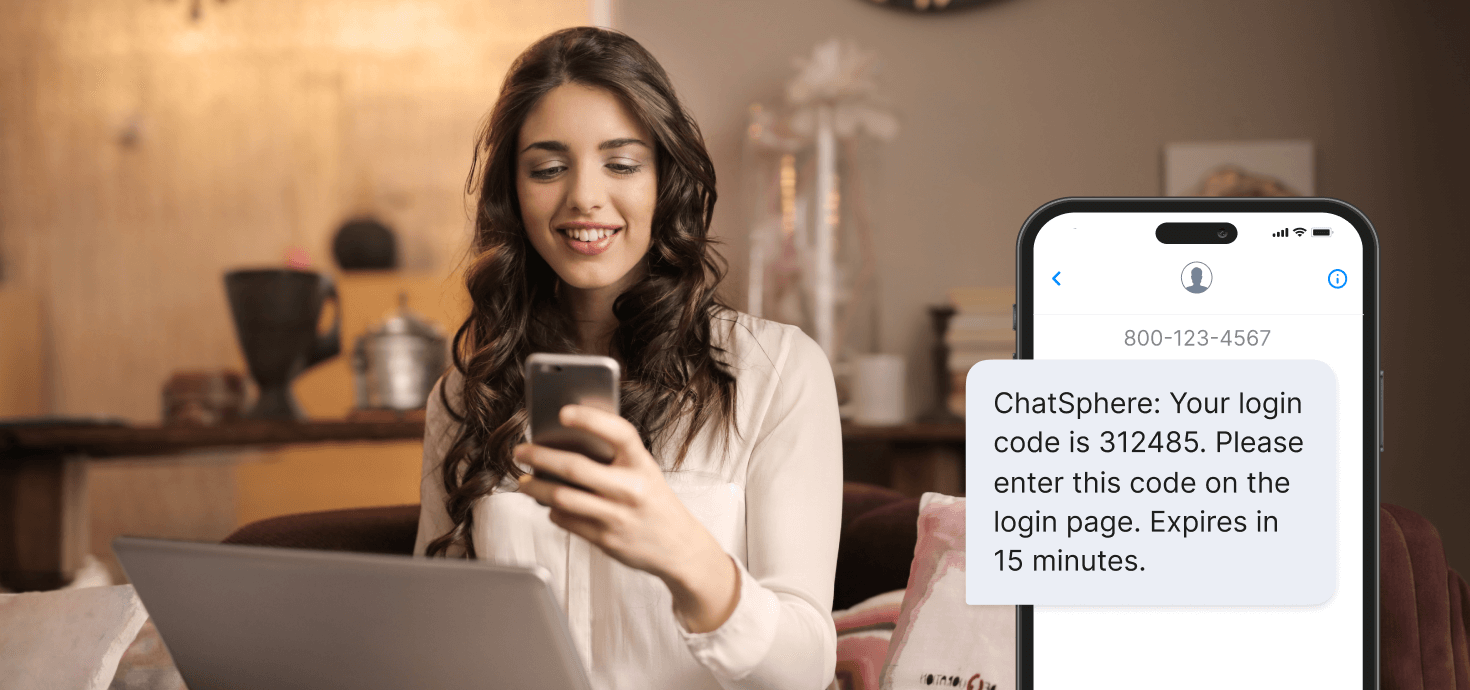

Secure client communication

Protect client accounts from fraud with SMS and Email. Build with our API to send 2FA authentication codes for logins and transactions.

Accelerated loan applications

Send immediate status notifications and document reminders to reduce delays and improve completion rates.

Automated billing reminders

Improve on-time payments automatically by sending timely billing reminders and confirmations that keep clients accountable.

Built-in audit trails

Ensure every interaction is recorded, organized, and delivered securely to stay aligned with industry regulations.

Efficient client intake process

Speed up client intake with automated forms, reminders, and updates to ensure new clients complete everything on time.

Secure client communication

Protect client accounts from fraud with SMS and Email. Build with our API to send 2FA authentication codes for logins and transactions.

How accounting and finance professionals use Textmagic

drives faster decisions, better compliance, and stronger retention.

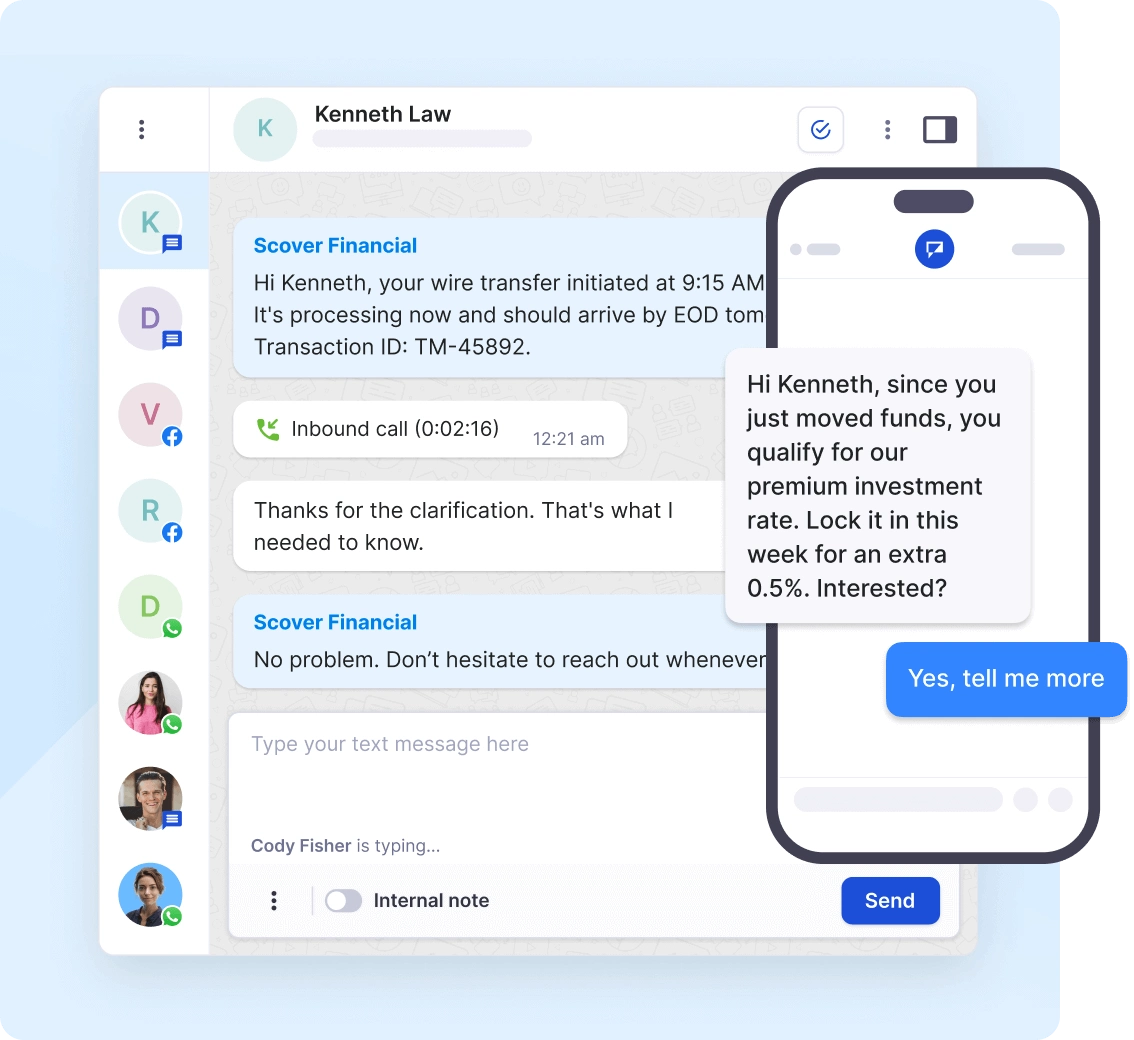

Investment offers

Share investment opportunities, portfolio updates, and urgent changes to keep clients informed.

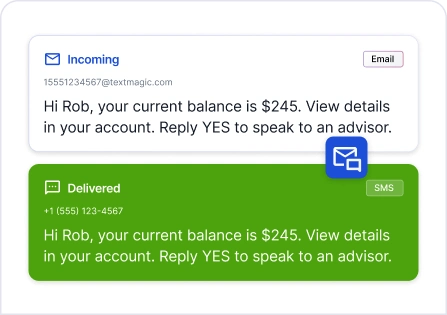

Bank balance and statements

Deliver real-time balance updates and statement reminders to help clients keep finances in control.

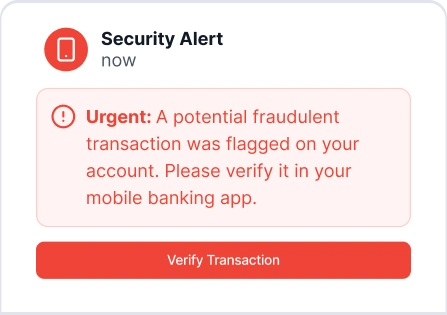

Fraud and phishing alerts

Warn clients about potential fraud or phishing attempts, so they take action before damage occurs.

Internal policy updates

Send compliance notices, policy reminders, and regulatory changes to ensure full adherence.

Workflow & approval notifications

Notify team members when approvals, document reviews, or financial checks are needed.

System and security alerts

Deliver instant alerts about system downtime or operational incidents to maintain service continuity.

Everything you need to run financial operations

and resolve issues with an SMS and email platform built for financial services.

Discover why over 2,000 financial businesses worldwide trust Textmagic

- Rated ★★★★★ on Capterra & G2

- Over 20 years of trusted communication solutions

- Driving 5+ million financial messages monthly

“Textmagic is easy to navigate, and enhances our ability to reach customers in rural areas.”

“Instead of chasing phone calls, Textmagic makes it simple to reach our clients instantly.”

Expert tips to help with communication in finance

What is SMS OTP (One-Time Passcode) verification?

Learn how SMS OTP works and why it’s become a crucial tool for businesses in safeguarding user transactions and data access. Bu…

Two-Factor Authentication text message: Is SMS 2FA secure?

As cyber criminals become more innovative in their efforts to break down users’ defenses, businesses must become more active in …

Scam text message examples and how to stay safe from phishing

Text message scams, also known as SMS scams or text message fraud, refer to deceptive and fraudulent schemes conducted through tex…

Frequently asked questions

Haven’t found what you were looking for? Contact us now

Textmagic helps financial institutions send SMS and email responsibly with opt-in workflows, clear sender identification, and consent tracking. This supports carrier and regulatory expectations while protecting your clients.

You can stay compliant by:

- Collecting and storing opt-ins before sending

- Including required STOP/HELP language in SMS

- Using verified sender domains for email

- Keeping messaging consistent and auditable across teams

- In the US & CA: Sending SMS campaigns ONLY from verified Toll-free or 10DLC numbers.

- In the UK & EU: Sending communications from a recognizable sender ID (business name or registered number) for better trust and compliance.

- For other regions, verify carrier and regulatory requirements with our support team before launching campaigns.

This keeps your outreach trusted, approved, and delivery-ready.

Financial institutions handle confidential client information daily. Textmagic provides secure SMS and email delivery with enterprise-grade security, consent management, and audit trails to ensure client data stays protected while meeting regulatory requirements.

Security features include:

- Encrypted data storage

- Clear sender identification to prevent spoofing

- Audit logs for compliance and monitoring

- Two-factor authentication and role-based access controls for team accounts

- GDPR and industry compliance support

Your clients can trust that their account updates, transaction alerts, and personal information are handled securely.

Textmagic supports both informational and transactional communication. Financial teams use SMS and email for essential updates, service workflows, and secure client care.

Common finance messages include:

- Account and transaction updates: deposits, transfers, balance notices

- Application status alerts: loan approvals, missing documents, next steps

- Fraud and security warnings: suspicious activity notifications

- Appointment and advisory reminders: consultations, renewal check-ins

- Policy or service updates: rate changes, new products, regulatory notices

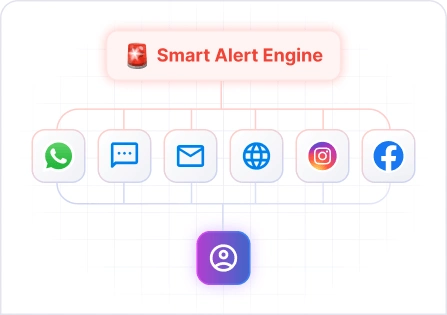

SMS and email serve different purposes in financial communication. SMS grabs attention quickly for time-sensitive alerts, while email delivers full context for detailed communication clients may need to reference later.

Use SMS for:

- Urgent alerts (fraud warnings, transaction confirmations)

- Appointment reminders and time-sensitive action items

- One-time passwords and verification codes

- Quick status updates and two-way client conversations

Use email for:

- Statements, summaries, and detailed reports

- Detailed onboarding or verification steps

- Product explainers and investment offers

- Compliance notices and formal documentation

- Follow-ups that include links or attachments

Learn best practices for both channels in our email campaign guide.

Textmagic helps banks, lenders, fintechs, and advisory teams engage clients through fast, reliable SMS and email. With timely updates and two-way messaging, you keep clients informed, responsive, and supported while reducing manual follow-ups.

Typical engagement wins include:

- Faster replies to client questions via two-way SMS chat

- More consistent onboarding and service updates

- Personalized outreach based on client segments or needs

- Higher trust through compliant, opt-in messaging

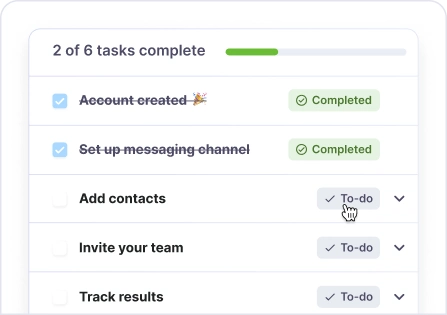

Textmagic is designed for quick deployment without requiring complex technical setup. Whether you’re a solo advisor or a growing fintech team, you can start sending secure messages within minutes.

Implementation is straightforward:

- No credit card required to get started—test with free credits

- Pre-built templates for common financial workflows (reminders, alerts, onboarding)

- Integrate via API or connect third-party apps with Zapier

- Drag-and-drop automation builder requires no coding

- Our support team is available to help with compliance questions

Ready to get started? Check out our getting started guide to launch your first campaign today.

While Textmagic is ideal for legitimate financial services, certain types of messaging are prohibited to protect consumers and comply with regulations.

Prohibited financial content includes:

- Debt collection communications: Any messages attempting to collect debt or pursuing delinquent accounts

- Deceptive financial offers: Predatory lending, payday/short-term loans, get-rich-quick schemes, or MLM promotions

- Unlicensed financial services: Unregistered investment advice, debt repair/forgiveness schemes, or unlicensed lending

- Gambling or betting: Promotion of online gambling, sports betting, or casino services

- Unsolicited or spam messaging: Any messages sent without proper opt-in consent

- Phishing or fraud: Messages that impersonate institutions or solicit sensitive information deceptively

Textmagic is perfect for: Account notifications, appointment reminders, loan application status updates, advisory consultations, transaction alerts, onboarding sequences, and legitimate customer service communications.

If you’re unsure whether your use case is permitted, contact our support team before launching your campaign. Violations may result in account suspension.